Here is what you need to know.

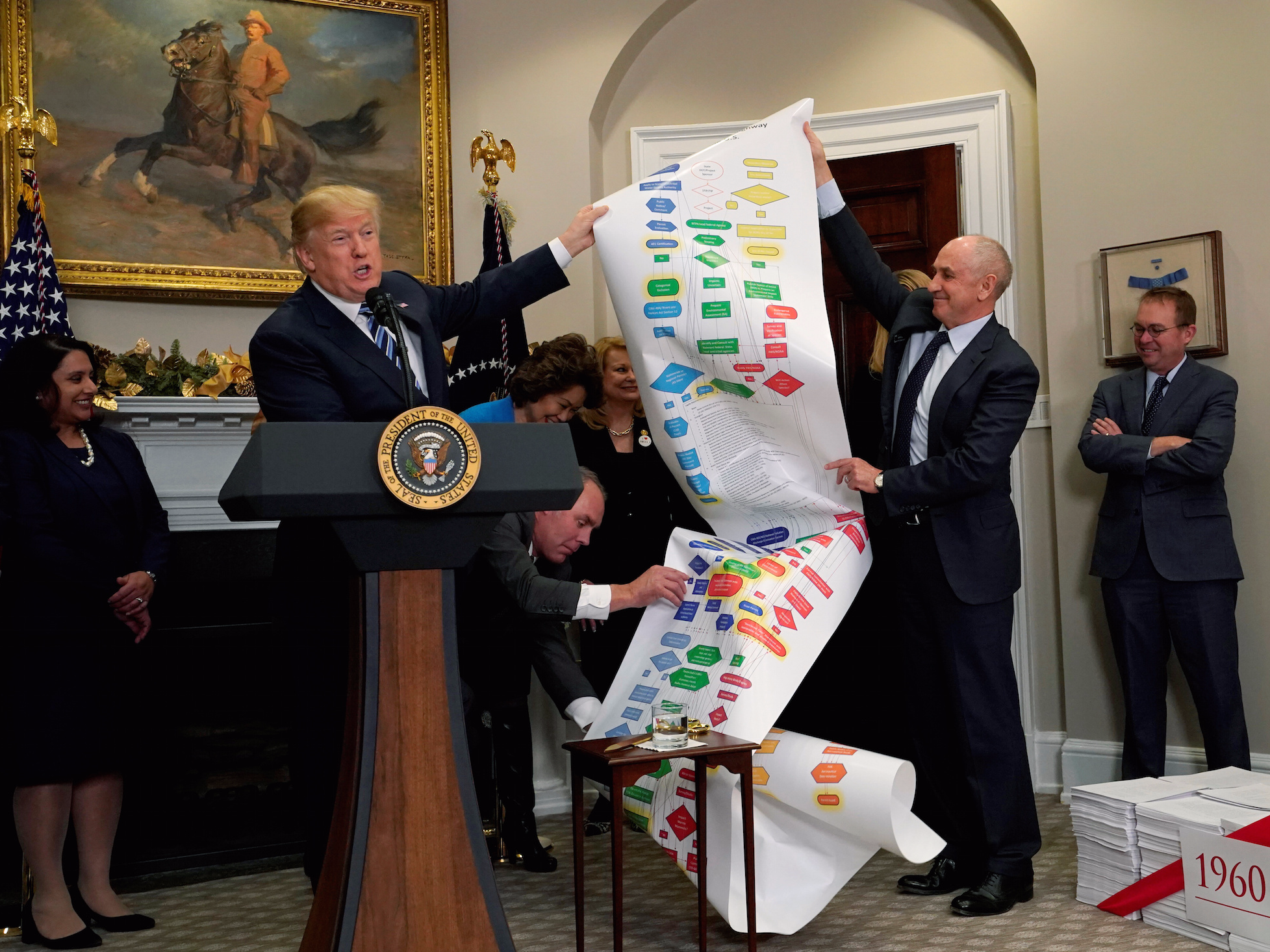

The FCC repeals net neutrality. The Federal Communications Commission voted 3 to 2 in favor of repealing net neutrality, which paves the way for broadband providers to sell different tiers of internet service but which critics say will leave consumers and web startups at the mercy of the big telecommunications companies.

JPMorgan sets its S&P 500 target for 2018. The JPMorgan quant guru Marko Kolanovic set his year-end 2018 target for the S&P 500 at 3,000 – as long as Republicans pass their tax overhaul.

Russia surprises with a bigger rate cut. The Central Bank of Russia cut its benchmark interest rate by 50 basis points to 7.75% (8% expected), noting a slowdown in inflation.

Bitcoin hits a new high. The red-hot cryptocurrency hit a record high $17,933 a coin on Friday, according to data from Markets Insider. It’s up 1,644% this year.

Ripple's XRP becomes the 3rd-largest cryptocurrency. XRP, which aims to use blockchain technology to speed up cross-border money transfers and bank settlements, became the third-largest cryptocurrency by market cap on Thursday as its total value hit $32.029 billion.

Disney is buying 21st Century Fox's studio and TV assets. The entertainment giant agreed to pay $52.4 billion for Fox's 39% stake in Sky, Star India, a collection of pay-TV channels like FX and National Geographic, as well as popular entertainment brands like X-Men, Avatar, and the Simpsons.

Oracle beats, but its stock sinks. The database giant beat on both the top and bottom lines, but its shares fell by more than 4% in after-hours trading on Thursday as its adjusted earnings-per-share forecast for the third quarter missed Wall Street estimates.

Spotify's valuation swells. The streaming-music service has seen its valuation swell 20% over the past few months to $19 billion as it readies to file for an initial public offering, sources familiar with the matter told Reuters.

Stock markets around the world are mostly lower. Hong Kong's Hang Seng (-1.09%) trailed in Asia, and France's CAC (-0.27%) lags in Europe. The S&P 500 is set to open higher by 0.21% near 2,657.

US economic data flows. Empire Manufacturing will be released at 8:30 a.m. ET before industrial production and capacity utilization cross the wires at 9:15 a.m. ET. The US 10-year yield is up 1 basis point at 2.36%.